If you're like most other SMSFs, you're forced to pay property loan interest rates between 9%-11%. Our groundbreaking SMSF loan refinance service can offer rates between 2% to 3% lower...

This means you save thousands and thousands in property loan repayments, making you wealthier (and happier) when you retire.

It’s Time We Talk About the Benefits of SMSF Loan Refinance

As an SMSF property owner, you’re no stranger to the ups and downs of investing. But what if there was a way to smooth out the bumps and increase your ROI? Enter SMSF refinance—the financial equivalent of hitting the reset button. Here are the several benefits of SMSF loan refinancing:

- - Lower interest rates: Refinancing can help you take advantage of lower interest rates and save on interest expenses.

- - Better loan terms: Refinancing can help you get better loan terms or more flexible loan features, such as longer repayment periods or lower fees.

- - Cash flow management: Refinancing can help you improve your cash flow by reducing your monthly repayments.

A Quick Chat Could Add Hundreds Of Thousands Of Extra Dollars To Your SMSF

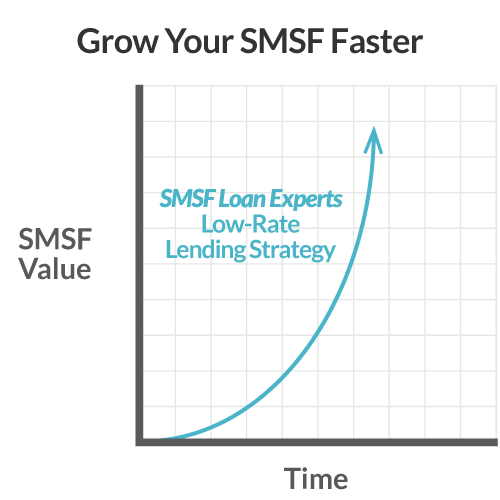

With a refinanced SMSF property loan from SMSF Loan Experts, you could save up to 2% per annum on interest repayments. On a $500,000 loan, that's $10,000 per year.

What does this mean for you? Adding an extra $10,000 per year to your SMSF could add $100,000 or $200,000 more to your final Super balance. All because you refinanced your investment property loan with SMSF Loan Experts.

What could you do with an additional $100,000 when you retire?

It's a no-brainer. A quick chat with us is all it takes to get started.

SEE IF YOU QUALIFY BY REQUESTING A FREE 15-MINUTE SMSF FINANCE SESSION

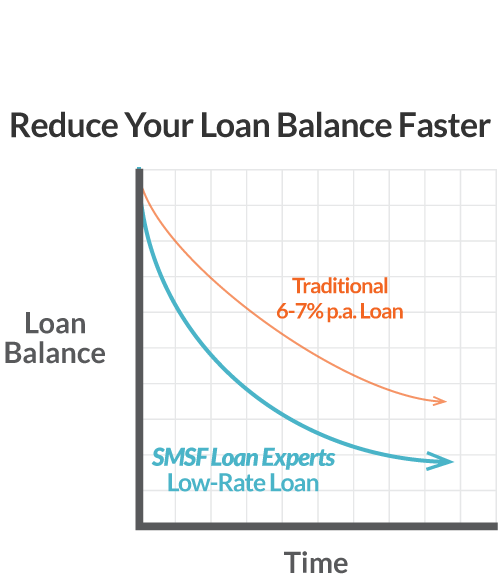

Here's How You Could Pay Off Your Loan Faster, And Grow Your Super More Quickly

Here's the fact of the matter - regular SMSF property loans aren't low-rate. In fact, their rates are generally higher than a typical home loan, which means most SMSF loans hinder the performance and growth of your Self Managed Super Fund.

Our SMSF experts will help you develop a comprehensive financial plan tailored to your needs. They can also help you understand the strategy's potential benefits and risks and guide you through the process to ensure a successful outcome.

When you pick our SMSF loan refinance services, you can:

- - Unlock lower interest rates to pay off your home or investment loan faster

- - Grow the value of your SMSF at a faster rate

- - Navigate a refinance quickly and easily — we'll do ALL the legwork for you

How This Done-For-You Refinance Service Provides Value To You

At SMSF Loan Experts, we specialise in this area. We can help you find the best SMSF loans available and negotiate favourable terms and conditions with lenders. This can help you save money on loan application fees, interest rates, and ongoing fees while ensuring your new SMSF loan aligns with your financial goals and circumstances.

Our team is here to streamline the process of refinancing an SMSF loan and free up your time and energy to focus on other important aspects of your life. Enquire now, or go to our FAQ page to see how we can refinance your existing loan and add a significant amount to your Super balance when you retire.

SEE IF YOU QUALIFY BY REQUESTING A FREE 15-MINUTE SMSF FINANCE SESSION