The lead-up to retirement is an exciting time for anyone who’s been in the workforce for decades. It’s often a pinnacle point in every Aussie’s life, yet one that can leave a few financial question marks looming overhead.

A transition to retirement pension is used by many Australians to slowly lead into retirement, both mentally and financially. We’ve prepared a quick guide on transition to retirement pensions and how they could work for you, as you slowly cease working!

What is a transition to retirement pension?

A transition to retirement pension (often abbreviated to TTR) is a type of retirement income stream that you can commence (using your superannuation funds) once you reach your preservation age. The income stream is designed to allow you the financial freedom to reduce your working hours in order to slowly transition into full retirement.

Transitioning to retirement may look slightly different for everyone, however, many people use a TTR pension account to draw a transition to retirement income that allows them to access the same amount of take home pay, while reducing their working hours, and their income tax.

Essentially, you take some money from your accumulation account (where your employer contributions and voluntary contributions have been building up over your working life) and shift them into an account based pension, then draw an income from the new account.

Benefits of a TTR pension

One of the obvious benefits of transitioning to retirement is that you get to put more of your time and energy into your personal life rather than into your work-life. However, above that, there are some other attractive benefits to starting a TTR pension:

- – A TTR pension opens up your career flexibility. It’s not just about working less, but potentially working in an area or industry that fulfils you or your retirement goals, or enables you to work longer than you would at a full time capacity.

- – TTR pensions open up strategic opportunities with your superannuation and overall financial situation as you lean into the retirement phase.

- – The tax-effective strategies that TTR pensions can allow you to employ, can actually help you grow your retirement savings further, while simultaneously tapping into them in the lead-up to retirement.

Key things to know about TTR pensions

TTR is a strategy, not just a pension

Pre-retirees don’t just get a TTR pension started out of the blue — TTR pensions form part of an overall transition to retirement strategy. Everybody’s personal circumstances are different, and with so many technical components to implementing a TTR strategy, it’s important that you access personal financial advice before making large-scale decisions around your superannuation.

The difference between retirement age and preservation age

Typically when people talk about their retirement age, they’re talking about the age that they can access government benefits (such as the age pension) rather than referring to the age they actually choose to retire.

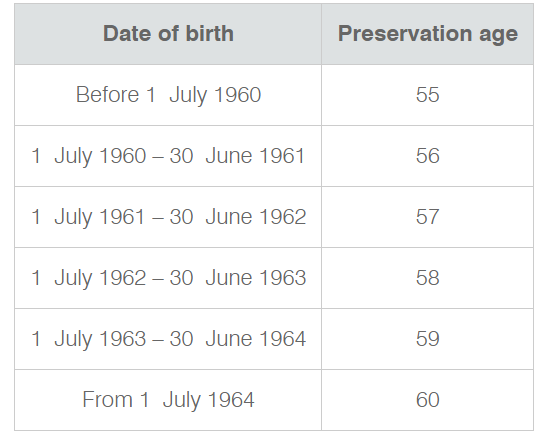

For the purpose of superannuation, though, your preservation age is the age that you can start to access your super account (and commence strategies such as a TTR strategy). Your preservation age depends on your date of birth, as shown in this table from the Australian Taxation Office.

Taxable and tax-free components

Aside from the lifestyle benefits, a major benefit of commencing a TTR pension are the tax efficiencies it can provide. As you’d be aware, investment earnings within super and your super contributions are taxed at 15%.

Your super balance is comprised of both a tax-free and taxable component. These components play an important role when it comes to your TTR pension income. TTR pension payments attract a 15% tax offset from the taxable component in your TTR pension, meaning you could lower your marginal tax rate!

Once you reach age 60, your pension income is generally tax-free.

Drawdown rates

Superannuation income streams are subject to a minimum and maximum drawdown rate. The minimum drawdown rate for a TTR pension is 4% of the pension account balance on the 1st day of the financial year (that is, the 1st of July), with the maximum being 10%. Most super funds allow you to take your TTR pension payments as regular payments over the financial year, or as a lump sum at the end of the financial year.

Keeping your accumulation account open

If you’re looking at continuing to work while you transition to retirement, you’ll need to keep an accumulation account open to accept employer contributions. There any many financial strategies that also utilise accumulation accounts while there is an account based pension open — however this is best determined by a licensed adviser under independent financial advice.

Transfer balance cap limits

There are limitations to how much money you can transfer into a tax-free retirement account within your superannuation. The transfer balance cap came into effect in 2017, and should be an important consideration when considering any pre-retirement strategy (especially if you’re an upper income earner).

Starting a pension account with a self-managed super fund

Your accountant and financial adviser can help with establishing a transition to retirement pension and calculate what your pension payments may be. The timing of implementing a transition to retirement strategy won’t come around without first considering your fund’s investment options and strategically shifting the assets supporting all the fund members, including the member commencing a pension account.

For SMSFs with direct property owned within them, the ongoing rental income may be a fantastic way to support the cash flow required to make pension payments, while continuing to access the capital growth potential for other fund members.

To ensure that you have the best lending structure to support direct property investment in your SMSF, whether you’re in accumulation or pension phase, contact the professionals at SMSF Loan Experts.